Interview to Justin Chadwick, CEO Citrus Growers Association of Southern Africa

Justin Chadwick, CEO Citrus Growers Association of Southern Africa. /CGA

Raquel Fuertes. Valencia Fruits

Recent years have been characterised by tensions between European and South African citrus growers. A different understanding of plant health and international trade protocols. A calendar in which, despite being off-season productions, there are more and more overlapping weeks for sweet citrus. Mutual accusations. We wanted to get the South African view of a relationship that is necessary due to obvious complementarities, but not without its points of friction. Justin Chadwick prefers to talk about ‘partners’ and common objectives in world consumption for a market in which he believes that ‘Spain is the world leader in citrus and should play a leading role in our sector’.

Valencia Fruits. In Spain we have heard a lot about your association, but perhaps we lack more direct information. Can you tell us what it is and what the Citrus Growers Association of Southern Africa does?

Justin Chadwick. We represent over 1.560 citrus growers in Southern Africa. We seek to maximise their long-term profitability. We do this in a number of ways through the CGA group of companies. These companies focus on, among other things, advocating for grower interests, keeping them informed, providing them with technical assistance, offering wide-ranging training, continuing the transformation of the citrus industry, as well as ensuring and increasing their access to markets.

VF. How is this citrus season looking in your country? What are your expectations for orange, mandarin, lemon and grapefruit production? Is there any fruit that is particularly growing?

JC. We are on course to achieve Vision 260 – a goal we have set ourselves as an industry. If all role-players work together, we can increase citrus exports to a total of 260 million 15kg cartons by 2032. This would create 100 000 additional jobs in a country that is struggling with unemployment. The 2024 season specifically, although coming in somewhat below our initial estimates, is looking good. Fruit sizes are a bit smaller due to dry and warm weather. The latest predictions indicate just over 173 million 15kg of citrus to be exported this season. Things could change, however. The higher juice price could mean oranges may be diverted from fresh exports to local processing.

VF. Are there any notable changes in exports forecast for 2024? Changes in demand? Any emerging problems? Any new markets?

JC. This year we facilitated the signing of a new protocol with Vietnam for oranges, opening that market up to our oranges.

A strong local juicing price has influenced our forecasts as well, in that some growers are now taking advantage of it and not exporting.

VF. What sanitary or climatological risks do you face in your crops?

JC. We have effective phytosanitary measures to make sure Citrus Black Spot (CBS) and False Codling Moth (FCM) remains under control, ensuring compliance with international regulations.

We are, as everyone, at the mercy of the climate. Extreme weather in the Western Cape (such as floods) and dryer weather in the Northern parts of the country do have impacts on growers.

VF. This week the Spanish Citrus Management Committee (CGC) warned about the reappearance of HLB in South Africa. You have warned on your social networks that it is African Citrus Greening. What is the difference between the two diseases and why do you not see it as serious as you perceive it from the perspective of European citrus growers?

JC. Asian Greening (HLB) has caused great devastation elsewhere in the world. African Citrus Greening is a different bacterium – one that responds differently to temperatures and is not nearly as destructive as HLB. African Citrus Greening has been in South Africa since 1932. Recently, it has been found in private gardens in the Eastern Cape, but its spread can be controlled through a variety of private and governmental measures. African Greening is under official control in South Africa.

It is important to emphasis as well that it cannot be spread by fruit or seed and there is no restriction on the movement of citrus fruit, and this applies worldwide.

The spreading of misinformation or false news has a negative impact on the entire citrus community. It erodes trust. Exporter countries damaging each other’s reputations has a wider effect as well: consumers are put off by these negative stories, no matter the country of origin. Citrus’s reputation as desirable product is then spoiled. The global citrus industry should rather work together to attract consumers to our category. Spain is a global citrus leader, and it should play a leadership role in our industry.

VF. Relations between Europe and South Africa in the citrus sector have been strained for a long time, especially with the European producer countries. What is the reason for this disagreement? Have the longer and longer calendars in both hemispheres had an influence, leading to overlapping seasons, whereas before it was only the off-season?

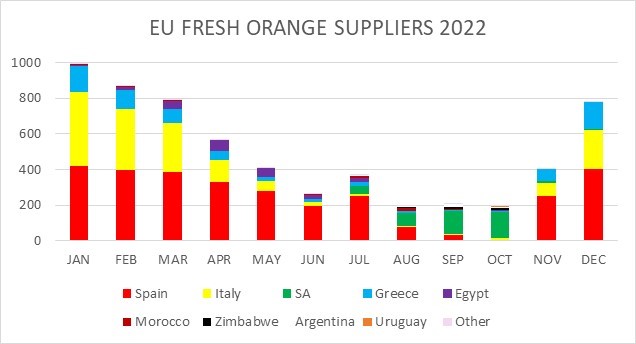

JC. Northern hemisphere and southern hemisphere production are largely complementary, and ensure good quality citrus is on the shelves all year round. While there is some economic impact regarding a short window where seasons overlap for some citrus sectors, I believe the greater economic effect can be a positive one – the hemispheres working together to increase the attractiveness and availability of its product. The hemispheres do complement each other – every season we “hand over” consumers to Spain – we must all keep consumers in the category with a steady supply, and then attract even more with our produce’s quality. We truly hope that this principle will guide South Africa’s future relationship with Spain. In the case of oranges the graph below illustrates the complementary nature of the southern and northern hemisphere trade.

In this respect, an organisation like the World Citrus Organisation has so much to offer.

VF. Why did they resist the application of cold treatment in their shipments to Europe?

JC. When the EU changed the quarantine status of False Codling Moth in 2018, South Africa developed a management system to address the phytosanitary concerns. This system was lauded as a world-leading system, and resulted in a decline in FCM interceptions from year to year. There was no sense in introducing new measures as FCM was being adequately managed. In addition, the system developed by South Africa was environmentally friendly, as high-risk fruit was subjected to additional treatment; the blanket treatment imposed by the EU made no sense in terms of sustainability, cost or pest management.

VF. Spain has accused you of not complying with cold treatment in your orange shipments. Are you really complying with EU regulations?

JC. We do comply with EU regulations. The regulations might be unfair and unscientific, but we do comply with them.

VF. Interceptions of citrus fruits imported from South Africa with black spot soared in 2023. What measures have been taken to tackle this problem?

JC. An analysis of the CBS interceptions raised questions over some EU member states’ ability to correctly identify pests. Investigations by Citrus Research International into the interceptions have revealed a number of false positive results and erroneous reporting, including cases where (a) the pest does not occur in South Africa; (b) the fruit was produced in a pest free area; (c) the fruit was produced in a place of production considered to be pest free or (d) there was clear evidence that the pest was not alive.

Problems with certain EU member states’ identification of pests, can affect all other member states.

South Africa has a world-class Risk Management System in place. This includes detailed spraying and inspection regimes, all strictly monitored.

It is striking that, with an increase in the number of cases detected with black spot, the South African government recently called the European Commission to the World Trade Organisation (WTO) for consultations to question its regulations to prevent the arrival of the black spot.

The WTO process is not confrontational or aggressive. The goal is scientific truth and fairness. Our growers have been under severe financial pressure because they are forced to comply with completely unnecessary CBS-related EU measures to maintain their market access. These measures cost them R2 billion a year. There is no scientific justification for treating fruit without leaves or twigs as a pathway for the disease, which means that the disease cannot spread through fruit only, which is the product South Africa is exporting.

Furthermore, the additional application of plant protection products to meet the requirements of the EU measures has detrimental environmental impacts, at a time when the EU is foregrounding environmental stewardship through the Green Deal and sustainability goals.

VF. A few months ago it was you who accused the European authorities about plant health controls, why? What were your real concerns? Have they been resolved?

JC. A number of reported interceptions were found to be incorrect (as mentioned above). South Africa needs to have confidence that the system is applied correctly. Evidence provided by member states on some of the alleged interceptions were investigated and found to be incorrect. This was communicated to the EU so as to improve identification competence and capacity.

VF. What is the plant health risk in this citrus trade?

JC. The risks are serious, and the consequences are considerable – which is why South Africa supports a rigorous risk management system, and why we are signatories to International Plant Protection Convention (IPPC). However, all measures must be based on good science.

In an increasingly globalised world, the concept of ‘asymmetric globality’ is being coined in Europe in terms of agri-food trade because it is understood that products coming from non-European countries do not meet the same requirements as more European products (it is considered that standards are higher for European products).

South Africa offers citrus products that measure up to EU standards. We take as much pride in delivering a safe product of high quality as anybody in Europe does. South Africa has strict labour and environmental laws. Industry and government have developed robust systems to ensure the highest standards of ethical production and environmental stewardship.

VF. What are the phytosanitary regulations in South Africa?

JC. South African phytosanitary measures are managed by regulations and legislation in South Africa. For instance, the Plant Health Bill is regularly amended to stay relevant.

We also know little about the working conditions of farm workers in your country. Could you comment on the average wages there, the general framework of working conditions and what is the real purchasing power of these workers?

The citrus industry sustains 140 000 direct livelihoods in rural communities throughout the country. As part of a country struggling with poverty, stagnant growth and unemployment, we strive to create as many new jobs as possible – as is also part of Vision 260. Workers are the lifeblood of our industry. It is in our industry’s interest to make sure that they work under the best possible conditions and that they receive fair wages. Citrus farms are integral parts of rural communities and their influence stretches far, often in the form of community support and training initiatives. Wages in the citrus industry far exceed the minimum wages set by government.

VF. Do you consider that they compete on the international market under the same conditions as producers from other countries in your area and other countries in the northern hemisphere?

JC. Given the history of South Africa, the working conditions on farms are amongst the most progressive in the world.

VF. What role do Spanish companies play in South African citrus growing?

JC. Spanish companies do have some farms in South Africa.

VF. With all that has been happening in recent years, is Spain (and, by extension, Europe) mainly a destination for your exports or a competitor for you?

JC. We value Europe and Spain as a partner in growing the number of global citrus consumers. As market, just over one third of our citrus is exported to Europe. Spain is not a competitor – South Africa and Spain are partners in keeping Europe supplied with good quality, safe, healthy and nutritious citrus fruit throughout the year.

VF. In what direction do you expect your country’s citrus production to progress? What is the future you would like to see?

JC. As outlined above, all our efforts are concentrated into achieving Vision 260. An essential part of this is in keeping current and creating new markets. We expect sustainable and responsible growth going forward.

VF. What do you think the relationship between South Africa and Spain on citrus should look like in the future?

JC. The CGA place very high value on uniting all citrus growers around the world into a group that works collectively towards a better global citrus industry. In this united effort all responsible citrus growing role-players will work together to grow the citrus category, to ensure consumer choice, quality, safety and all-year access to citrus. Citrus industry players around the world have much more in common than that which divides us.

We would love a close relationship with the orange and mandarin sectors in Spain as we have with the lemon and grapefruit sectors. We would love to be able to share information, to co-operate on giving consumers a great year-round citrus-eating experience.

Access to the interview on pages 8-9 of the Valencia Fruits issue.

Full access to the last issue of Valencia Fruits.